Employee Benefits

- Summary Annual Report for Welfare Benefits Plan

- Information for New Hires

- Medical

- Dental

- Life Insurance

- Retirement

- Short-Term Disability

- Long-Term Disability

- Vision Care - Humana

- Health Savings Account (HSA)

- Employee Assistance Program

- Tuition Benefits

Information for New Hires

Learn About the benefits available to new hires in the JU 2025 New Hire Booklet

Review your Digital Education Kit.

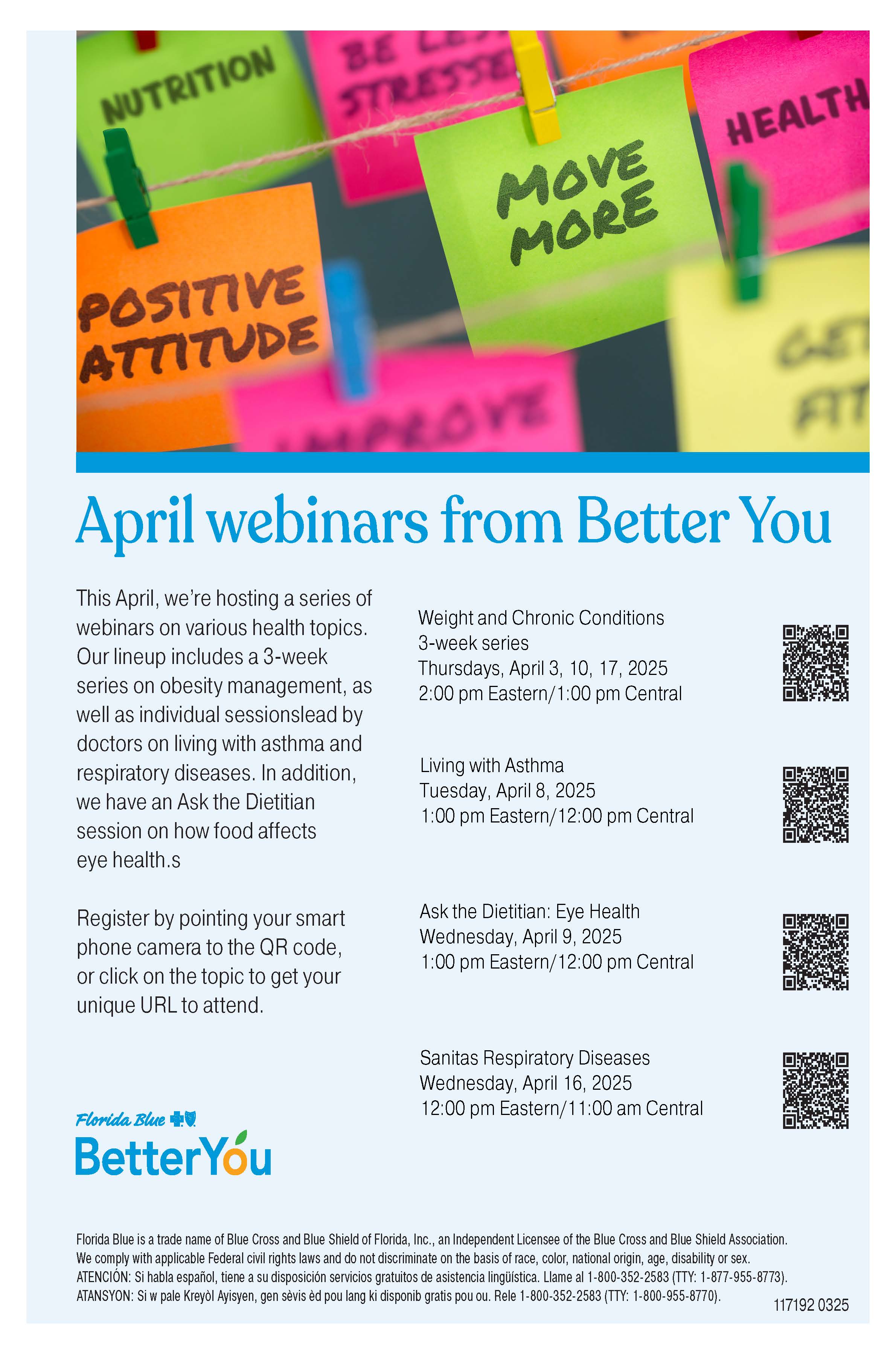

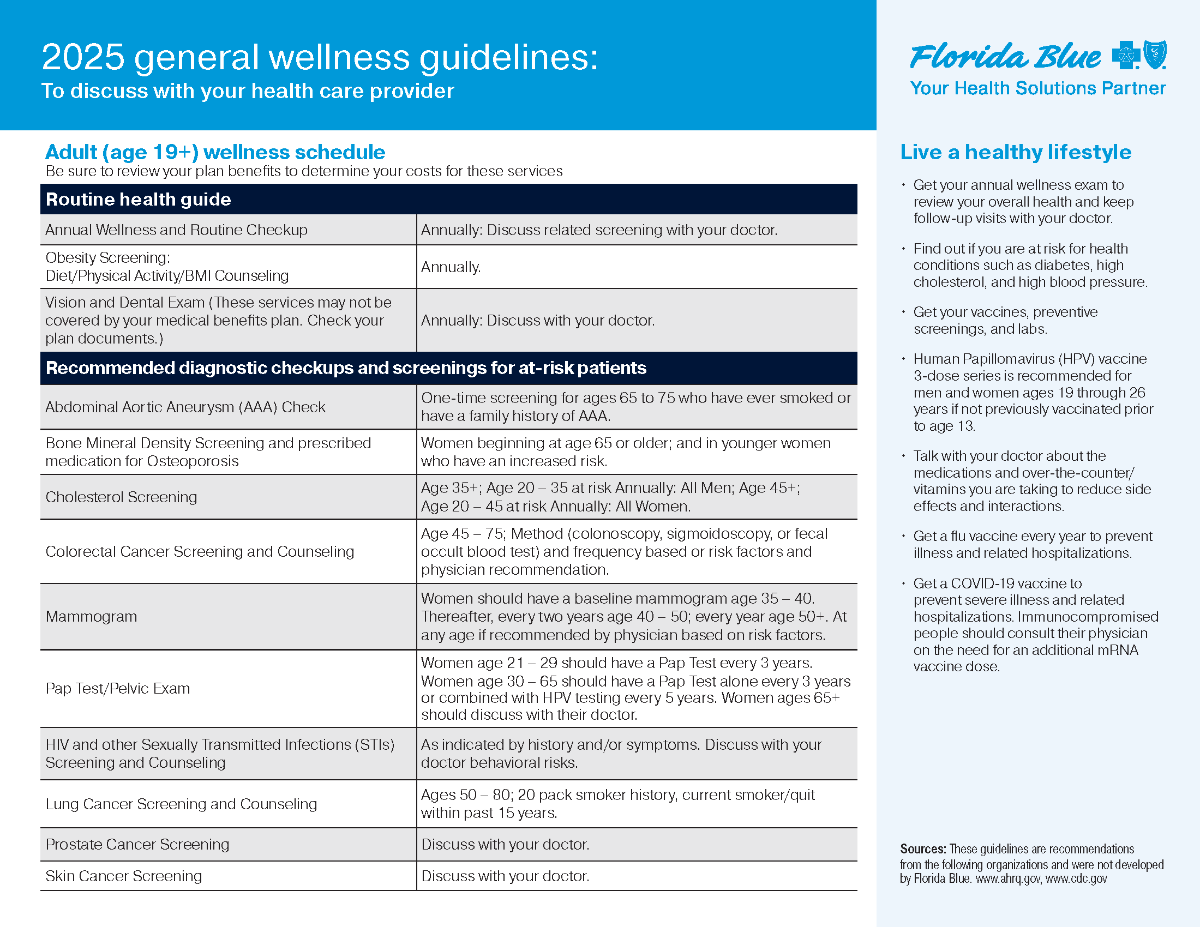

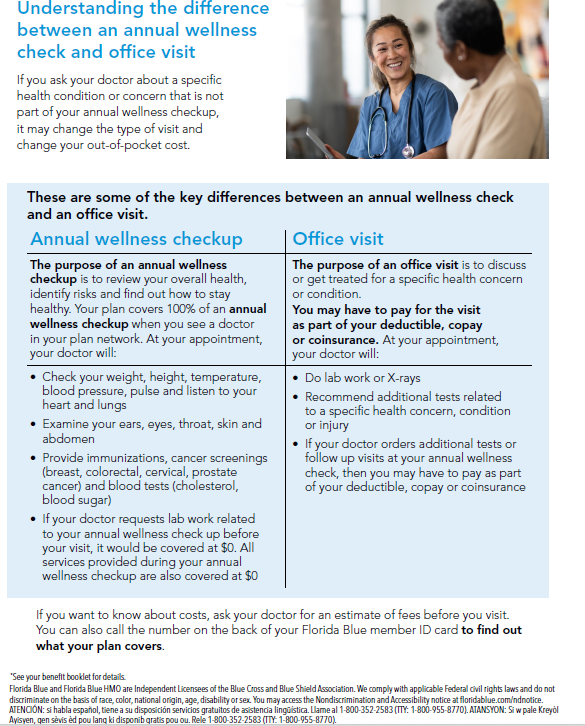

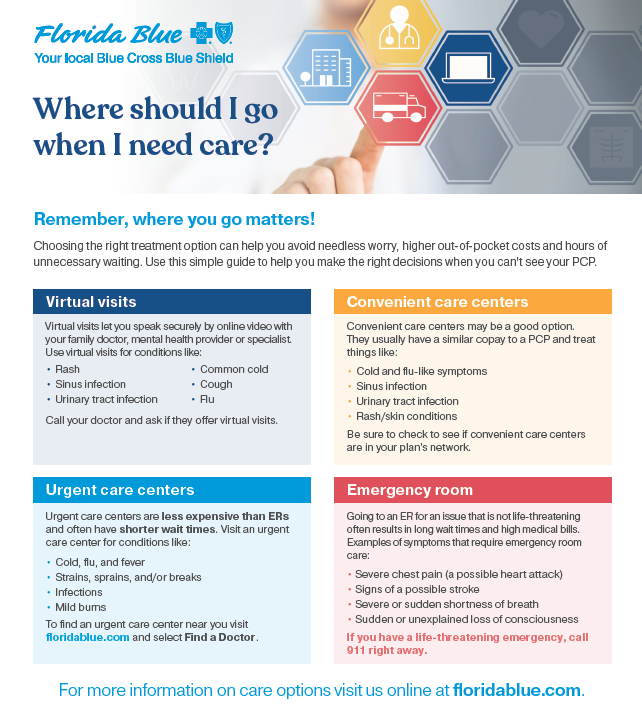

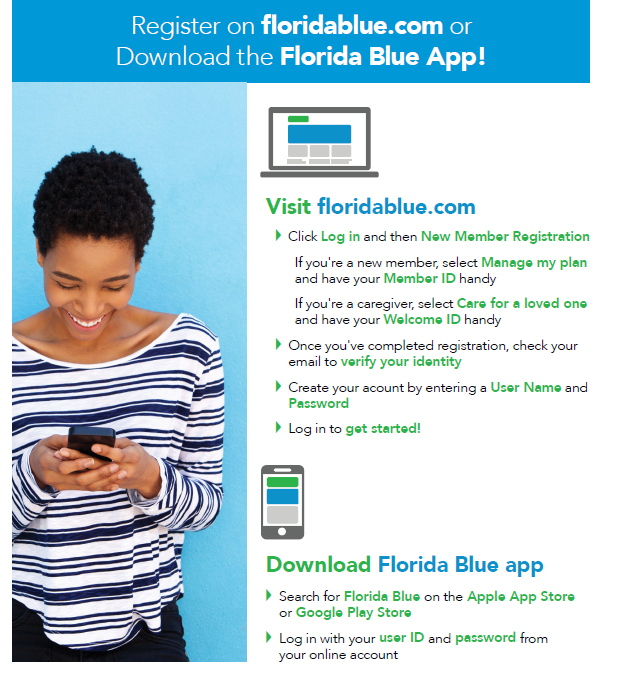

Medical

Florida Blue (Blue Cross Blue Shield)*

- Health Options (HMO Blue Care 60)

- BlueOptions PPO (PPO 3559)

- BlueOptions (PPO 3160/3161)

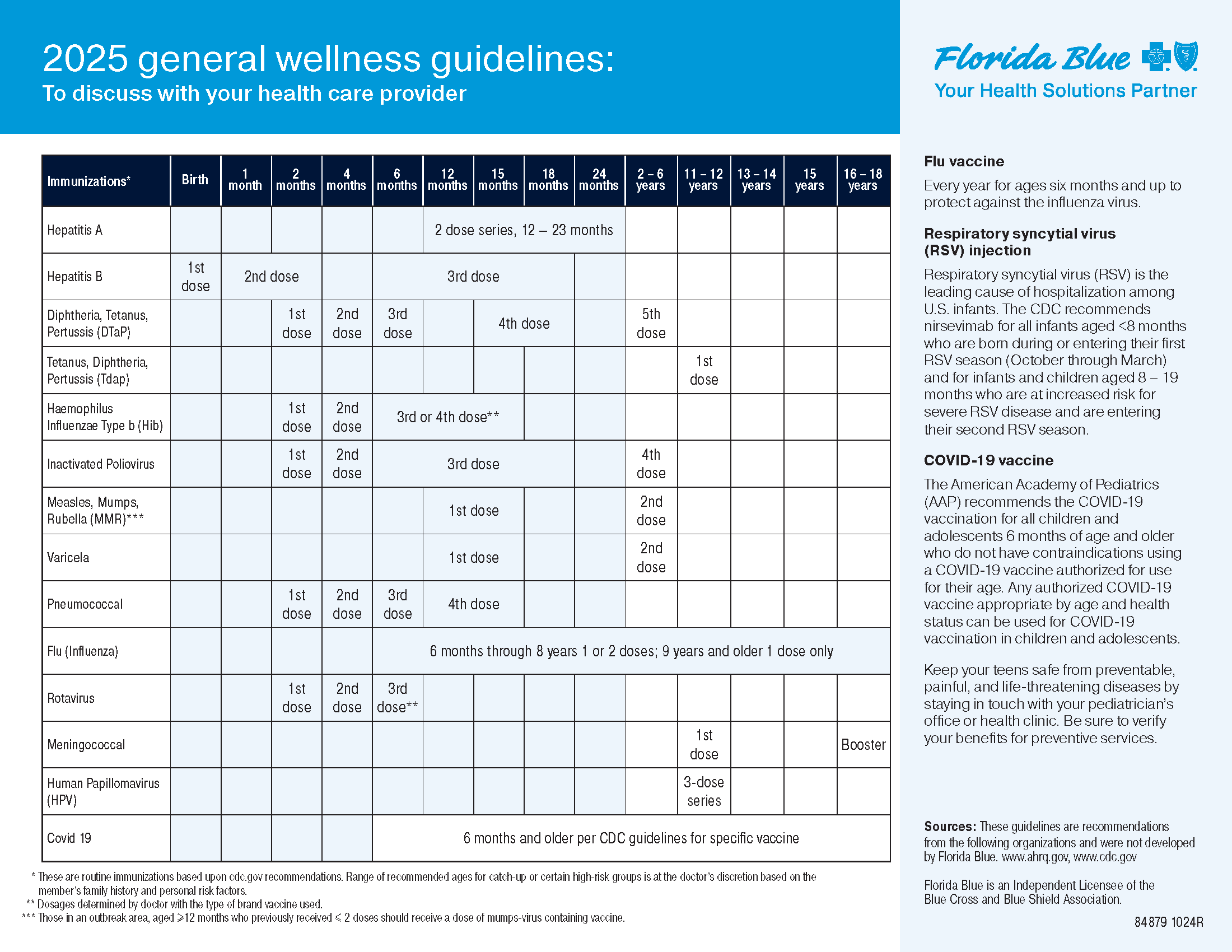

The University offers a choice of three plans with Florida Blue: an HMO Blue Care Option, a Preferred Blue Option, and a High Deductible Blue Options Plan (please see the available HSA information below). For further information see the Medical Benefit Summary below which provides you with the monthly rates. Medical coverage is effective on the first of the month following thirty days of employment.

For further information go to the Florida Blue web page.

2025 Medical - Employee Monthly Costs

| Florida Blue Care 60 - HMO | Blue Options PPO 3559 | Blue Options HD 3160/3161 | |

|---|---|---|---|

| EE Only | $95.00 | $194.00 | $78.00 |

| EE / Spouse / Domestic Partner | $604.00 | $761.00 | $247.52 |

| EE / Children | $446.00 | $525.00 | $125.62 |

| Family | $735.00 | $893.00 | $523.92 |

APRIL 2025 Monthly Wellness Newletter Links:

Need help with quitting? Visit smokefree.org

You can also use the self-referral form here.

For more information on preventative care, visit the Centers for Disease Control & Prevention.

Nourishing Hope- treating eating disorders:

Resources: National Eating DIsorders Association & BlueAnswers

Recipe of the month: Avocado Hummus from Eatingwell.com

Nutritional information click here

Dental

Blue Cross Blue Shield, BlueDental Care (Co-Pay), BlueDental Choice (PPO): FL Combined Life Dental Insurance

The University offers two dental plan options that allow you to choose any dentist from the network to receive full benefits according to a calendar year limit of $1,500 per insured participant, including Orthodontia services. To find providers: www.floridablue.com, then "Find a Provider" and search using a dental specialty.*** The option to go outside the network is available at a higher cost using coinsurance rates, where balanced billing may be applicable.

The Co-Pay plan charges co-payments for specific services within the network (fee schedule is available) and coinsurance for services outside the network. The traditional plan (PPO) charges coinsurance for services inside and outside the network with a lower outside of network coinsurance rate than the Co-pay plan, but the premium deductions are approximately double that of the Co-Pay plan. Please refer to the Forms page for the electronic version of these two plans.

| Dental - Employee Monthly Costs | Blue Dental PPO Co-pay Plan |

Blue Dental PPO Choice Plus Plan |

|---|---|---|

| Employee Only | $16.50 | $35.92 |

| EE / Spouse / Domestic Partner | $39.82 | $72.84 |

| EE / Children | $42.74 | $80.62 |

| Family | $62.16 | $117.52 |

After June 1,2013, the new customer service phone number is 1-888-223-4892. Paper claims may be sent to the Dental Administrator; P.O. Box 1047; Elk Grove Village, IL 6009-1047.

Jacksonville School of Orthodontics

Jacksonville School of Orthodontics offers a 10% discount to the employee and/or one member within the employee’s immediate family. A JU ID Card must be shown at the time of services. Please call the School of Orthodontics for details on the 10% discount and to set up an initial appointment.

Life Insurance

The Standard

Group Term: Jacksonville University provides you with 1x your annual base salary in life insurance, to a maximum of $150,000. You have the option to purchase another 1, 2, or 3x your base salary at low group term rates. Spousal insurance is available at 50% of employee election in increments of $5,000; and dependent children a maximum of $10,000. Life Insurance coverage is effective the first day of the month following thirty days of employment. Please note that at age 65, the amount of coverage decreases 35%; and at age 70, it decreases to 50% of annual salary.

Retirement

IRS Announces 2025 Plan Contribution Limits

The IRS announced cost-of-living adjustments (COLAs) affecting the dollar limits for pension plans and other retirement-related items for the 2025 tax year. The 402(g) elective deferral contribution limit for employees who participate in 403(b)/401(k) plans is $23,500. The catch-up contribution limit for those age 50 and over is $7,500.

This benefit is offered through TIAA-CREF and VALIC. The employee can contribute up to 6% of base salary with pre-taxed dollars, which is 100% matched by JU. Eligibility for the Defined Contribution Plan (RA) is effective following one year of employment. The one-year waiting period is waived if, immediately prior to your employment at JU, you were previously employed for a minimum of one year with a higher education institution. Eligibility for the Tax Deferred Annuity Plan (SRA) is effective immediately upon your employment. The University also offers a supplemental plan through which employees can contribute additional pre-taxed dollars up to the amounts allowed by law. For further information go to the TIAA-CREF web page or to the VALIC web page.

Spring/Summer Webinars Available

You can find webinar times below and register for upcoming sessions at TIAA.org/webinars

APRIL

Quarterly economic and market update

Apr. 10 at Noon (ET), 11 a.m. (CT), 10 a.m. (MT), 9 a.m. (PT)

Fine-tuning your retirement strategy: Investing toward a secure future

Apr. 16 at 2 p.m. (ET), 1 p.m. (CT), noon (MT), 11 a.m. (PT)

Start to Finish: The early career woman’s guide to financial wisdom

Apr. 18 at 3 p.m. (ET), 2 p.m. (CT), 1 p.m. (MT), noon (PT)

Staying safe in the Age of AI

Apr. 24 at 1 p.m. (ET), noon (CT), 11 a.m. (MT), 10 a.m. (PT)

MAY

Opening doors to the future: Save in a 529 college savings plan

May 1 at Noon (ET), 11 a.m. (CT), 10 a.m. (MT), 9 a.m. (PT)

Invest for Success: 5 principals you need to know

May 7 at 2 p.m. (ET), 1 p.m. (CT), noon (MT), 11 a.m. (PT)

Basic Estate Planning Strategies

May 16 at 3 p.m. (ET), 2 p.m. (CT), 1 p.m. (MT), noon (PT)

Make the move toward long-term financial security: Your mid-career retirement check-in

May 21 at 1 p.m. (ET), noon (CT), 11 a.m. (MT), 10 a.m. (PT)

JUNE

Write your next chapter: 5 steps to setting your retirement date

June 4 at Noon (ET), 11 a.m. (CT), 10 a.m. (MT), 9 a.m. (PT)

Charting your Course: A financial guide for women

June 12 at 2 p.m. (ET), 1 p.m. (CT), noon (MT), 11 a.m. (PT)

The Starting Line: Beginning to save for retirement

June 20 at 3 p.m. (ET), 2 p.m. (CT), 1 p.m. (MT), noon (PT)

Take control of your financial life: 5 steps to managing money and debt

June 25 at 1 p.m. (ET), noon (CT), 11 a.m. (MT), 10 a.m. (PT)

Summary Plan Descriptions

Annual Disclosures & QDIA

2019 Plan Updates

Short-Term Disability

The Standard

This optional benefit will pay 50% of salary up to $500 per week and start on the 1st day for an accident and the 8th day for illness. It is provided by Jacksonville University for all empoyees at no cost. Coverage is for 6 months. Maternity is covered. Short term disability fills the gap before long term disability becomes available. The coverage is effective the first day of the month following thirty days of employment.

- Group Accident Insurance

- Group Critical Illness Insurance

- Group Basic Life & Accidental Dealth & Dismemberment Insurance

- Group Additional Life Insurance

- Group Short Term Disability Insurance

Long-Term Disability

The Standard

This benefit will pay 70% of salary up to $10,000 per month up to age 65. It is provided by Jacksonville University for all employees at no cost. Long Term Disability is effective the first of the month following 30 days of employment for Administration, Faculty, and Staff.

Vision Care - Humana

CompBenefits' VisionCare Plan provides eye exams, lenses and frames benefits through a full insured vision plan.

Plan benefits include periodic, comprehensive eye exams, lenses and frames or contacts. In addition you can get a discount on LASIK or PRK surgery. In the year after an eye exam, you'll also receive a 20 percent discount on a second pair of eyeglasses and/or a 15 percent discount on professional service fees for elective contact lenses from the VisionCare network doctor you have seen for your original services.

As a dual choice plan, VisionCare allows you to choose one of our pre-screened doctors or to visit a doctor outside the VisionCare network. This is a pre-paid plan offering benefits at no charge following a $10 deductible for exams within a network of providers and $25.00 deductible for purchased materials. You may choose a provider outside the network and be reimbursed according to a fixed schedule. Please refer to the electronic version of the brochure below for additional information.

Monthly Cost: Employee Only $6.50, Family $18.60

Vision members can express register at www.humanavisioncare.com to print an ID card or call vision customer care at 866.537.0229.

Flexible Spending Accounts

The FSA allows you to defer dollars tax-free to a savings account to pay for non-reimbursed medical, dental, vision care, prescriptions. Over-the-counter drugs are eligible only with a doctor's prescription. The FSA plan includes a debit card feature which allows you to swipe your card for automatic payment from the account at participating providers. Also available is a ChildCare FSA (DCA) that can cover dependent care expenses for children under the age of 13 (13 or older if mentally or physically unable to care for themselves, or dependent adults) while you are at work. Further information may be obtained on the Medcom website or by contacting the Office of People & Culture.

Health Savings Account (HSA)

The HSA is a new way for consumers to pay for medical expenses before you meet your deductible on the PPO 3160/3161 High Deductible plan. Qualified expenses include your out-of-pocket amounts for deductibles, prescriptions, dental care, or vision care. Over-the counter drugs are eligible only with a doctor's prescription. Funds can also be used for COBRA coverage during periods of unemployment, medical expenses after retirement and long-term care expenses. This benefit is for employees in the High Deductible 3160/3161 only.

Employee Assistance Program

An important benefit provided for all faculty and staff is the Employee Assistance Program (EAP). EAP services are available through Health Advocate, formerly Corporate Care Works. All sessions are completely confidential. The list below is not all inclusive, but are examples of some of the services provided:

- Coping with and managing stress

- Time Management

- Family Concerns

- Personal and Professional Development

- Coping with grief or loss

- Effective Communication

- Workplace Issues

- Alcohol/Drug Use

- Financial/Legal Referrals

EAP services are available day or evening hours and also provides crises assistance 24 hours a day. The EAP is pre-paid in full by the University and is free to you and your immediate family members.

For information, please contact the EAP (Health Advocate) at (877) 240-6863. Additionally, more great information can be accessed from the Online Solutions Center at: https://members.healthadvocate.com then type in Jacksonville University on the Welcome Member page. The Online Solutions Center offers resources tailored to specific life needs to help you through some of life's toughest challenges.

If you have any questions about this benefit, contact the Office of People & Culture at 7025.

Tuition Benefits

Jacksonville University encourages its employees to continue their education in hopes of improving their knowledge, skills, and abilities. Tuition benefits are granted to eligible Regular Full-time employees of the University after 90 days of service. Effective April 30, 2022, Programs covered by tuition benefits are bachelor degrees, continuing education and master's degree with the exception of: Master's of Speech Language Pathology, Master's of Health Informatics, Master's of Clinical Mental Health Counseling, and Juris Doctor. Additionally, the On-Line Nursing Program and Doctoral programs are not covered by tuition benefits.

Tuition benefits are available to the employee, spouse, domestic partner, and eligible unmarried dependent children. The dependent child(ren) must be 25 years of age or younger and residing in the employee's home. For further details, see the Tuition Benefits Policy in the Employee Handbook.

The tuition waiver form must be submitted prior to the payment deadline for the term

the benefit is utilized.

The tuition waiver only covers tuition. The employee is responsible for all other

student fees by the payment deadline for that semester:

- Fall-July 1

- Spring-December 1

- Summer-May 1

Jacksonville University also is a participant in The Tuition Exchange. Further details on this program are available at the site below. If you wish to apply for The Tuition Exchange, please contact the Executive Director of Student Financial Services by emailing cmoore@ju.edu or by dialing (904) 256-7060.

The University has a current reciprocal tuition program with The Bolles School and St. John’s Country Day School.

Jacksonville University currently has a reciprocal tuition arrangement with The Bolles School. We are pleased to report that currently enrolled students who are already covered by the JU/Bolles benefit will be grandfathered under the prior tuition discount and eligibility arrangements. For new enrollees, the revised policy is as follows:

- Bolles discount is only available for qualified students in grades 9 through 12

- An automatic 25% discount for up to two children in a family; families can apply for financial aid above that amount

- Benefit is immediately available for two students; no waiting period

- Coverage under the reciprocal tuition program ceases upon termination of employment

- Interested applicants should contact The Bolles School Office of Admissions

If you have any questions, please do not hesitate to contact the Office of People & Culture at extension 7025.

*TUITION BENEFIT Excludes Upskill Courses*

Tuition Benefits for Adjuncts

Adjunct faculty are entitled to a tuition waiver according to the following guidelines:

Amount Earned

A tuition waiver is available on a 1:1 basis. For each one-credit hour taught, one credit hour waiver is earned at Jacksonville University. Tuition waivers are applied to the semester that follows the semester of instruction. Adjuncts can take graduate courses upon prior approval from the SVPAA. There are, however, some restrictions and tax implications for some programs.

Transferability

Tuition waivers are transferable to the spouse of the adjunct faculty member, or any dependent child who is 25 years old or less, who meets the IRS definition of a dependent AND who resides in the parents’ home.

Time Limitation

Waivers must be utilized within three (3) calendar years of the semester or term in which teaching credits are earned. Example: Courses taught in Fall of 2011 will be credited for tuition waiver through Summer 2014. At the start of Fall 2014, unused credits earned in Fall 2011 will roll off and be void.

ARAG Legal Insurance

- Legal Insurance from ARAG

- The ARAG Learning Center

- ARAG Implementation

- ARAG Legal App

- Services for Parents & Grandparents

- Additional Services